โจรแขนเดียวเป็นหนึ่งในเกมที่ง่ายที่สุดในคาสิโนนี่เป็นหนึ่งในเหตุผลว่าทำไมจึงเป็นที่สนใจของทั้งในคาสิโนจริงและห้องโถงเกมออนไลน์ การเล่นโจรแขนเดียวออนไลน์นั้นง่ายมากเพียงแค่ลงทะเบียนและเปิดบัญชีเข้าสู่หน้าเกมโจรแขนเดียวคุณก็สามารถเล่นได้อย่างง่ายดายหากคุณไม่เคยเล่นมาก่อนคุณสามารถดูบทแนะนำกฎของเกมได้ ที่นั่นและคุณจะรู้วิธีการเล่นในขณะที่ขึ้น วิธีการเล่นความบันเทิงออนไลน์ฟรีหนึ่งแขนโจร? นี่เป็นปัญหาที่มือใหม่กังวลมากเช่นกันหากคุณต้องการสัมผัสกับความสนุกของโจรแขนเดียวก่อนอื่นคุณต้องรู้ว่าเกมนี้เล่นอย่างไรนี่เป็นขั้นตอนพื้นฐานที่สุด ฉันได้ข้อสรุปจากประสบการณ์หลายปีว่าในความเป็นจริงเมื่อเล่นโจรผลไม้ออนไลน์หนึ่งแขนคะแนนไม่จำเป็นต้องเต็มเพราะเมื่อเต็มแล้วแม้ว่าคุณจะชนะทุกครั้งที่วิ่งคุณจะไม่ชนะคะแนนที่คุณเดิมพัน ทุกครั้งจึงไม่จำเป็นต้องได้คะแนนเต็มทุกครั้ง โดยทั่วไปมีความแตกต่างบางประการในเครื่องที่ผ่านโทรศัพท์มือถือโดยปกติแล้วถ้าคนสองคนกำลังเล่นไฟวิ่งจะชนประตูว่างเสมอหรือเดิมพันตำแหน่งแสงที่มีคะแนนน้อย หลักการของโจรแขนเดียวออนไลน์ก็เหมือนกับโจรแขนเดียวทั่วไปข้อแตกต่างคือคุณไม่จำเป็นต้องใส่เหรียญเพื่อดึงที่จับเพียงแค่แตะหรือลากเมาส์ มีชื่อต่างๆมากมายของโจรแขนเดียวออนไลน์หากคุณรักเกมโจรแขนเดียวฉันขอแนะนำให้คุณค้นหาบนอินเทอร์เน็ตอย่างรอบคอบเพื่อสัมผัสกับความตื่นเต้นของเกมต่างๆ พื้นฐานของเกมคาสิโนออนไลน์คือผู้เล่นต้องการมีประสบการณ์สล็อตออฟไลน์ที่สม่ำเสมอ ในและนอกเครื่องสล็อตเงินจริงจะถูกแทนที่ด้วยเหรียญเสมือนจริงซึ่งจะขจัดลักษณะของการพนันและกลายเป็นเกมสบาย ๆ ที่ถูกต้องตามกฎหมาย ดังนั้นการเข้าใจประวัติศาสตร์จึงเป็นพื้นฐานในการเข้าใจจิตวิทยาในเกมของผู้เล่น สล็อตแมชชีนเป็นหนึ่งในเกมคาสิโนที่ได้รับความนิยมมากที่สุดในโลกเนื่องจากความง่ายในการเล่นและความน่าดึงดูดใจในแง่ของแสงสีเสียง บรรยากาศที่สร้างขึ้นโดยเครื่องสล็อตในคาสิโนอิฐและปูนสามารถแข่งขันกับกราฟิกและมูลค่าความบันเทิงของคาสิโนสดทางอินเทอร์เน็ตซึ่งนำไปสู่การต่อสู้ของสล็อต ด้วยการพัฒนาของเทคโนโลยีและความนิยมที่เพิ่มขึ้นของคาสิโนออนไลน์และออฟไลน์เกมคาสิโนจำนวนมากได้พัฒนาไปอย่างมาก สิ่งที่น่าสังเกตมากที่สุดคือเครื่องสล็อตและช่องจ่ายเงิน องค์ประกอบของ ไม่ว่าคุณจะเล่น เกมสล็อตแมชชีน วิดีโอออนไลน์หรือสล็อตแมชชีนสามรีลแบบดั้งเดิมหลังจากถอดออกแล้วองค์ประกอบของมันจะเหมือนกันมากหรือน้อย หลังจากเรียนรู้พื้นฐานแล้วไม่ว่าคุณจะอยู่ที่ไหนคุณสามารถจัดการกับเครื่องสล็อตใดก็ได้เครื่องสล็อตทั้งหมดจะมียอดเงินในบัญชี (ยอดคงเหลือ), ช่องแสดงผล (กล่องแสดงผล), โต๊ะจ่ายเงิน (โต๊ะจ่ายเงิน), วงล้อ (วงล้อ), การเดิมพันต่อไลน์, จำนวนช่องจ่ายเงิน, เงินเดิมพันสูงสุดสูงสุดและปุ่มเล่น / หมุนหรือจอยสติ๊ก นักพนันหลายคนและได้ยินเรื่องราวที่น่าเศร้าต่างๆมากมาย หลายคนถามฉันว่าใครชนะในท้ายที่สุดจากการเดิมพันต่างๆ ตามสถิติและความเข้าใจของฉันฉันไม่พบนักพนันเช่นนี้ เป็นความจริงที่นักพนันบางคนได้รับรางวัลเป็นเงินจำนวนมาก แต่ในที่สุดพวกเขาก็อาเจียนออกมาและพวกเขาก็กลับมาเป็นหนี้ เซียนพนันบางคนมีชีวิตที่ลำบากมากหลังจากเลิกเล่นการพนันไม่มีทาง! ฉันสูญเสียเงินและเป็นหนี้ทุกหนทุกแห่ง ไม่มีนักพนันคนใดไม่รู้สึกเสียใจอย่างมากหลังจากเลิกเล่นการพนัน เมื่อก่อนฉันอาจจะขับรถง่าย ๆ และฮัมเพลงเล็ก ๆ น้อย ๆ ในชั้นเรียนเล็ก ๆ แต่ตอนนี้มันเป็นเพียงการหาเงินท่ามกลางลมและฝน ข้อเท็จจริงจำนวนมากพิสูจน์ให้เห็นว่าการพนันเป็นวิธีที่ไม่มีผลตอบแทน เพียงแค่ว่าผู้คนในเกมนั้นตาบอดจากภาพลวงตาที่อยู่ตรงหน้าพวกเขา […]

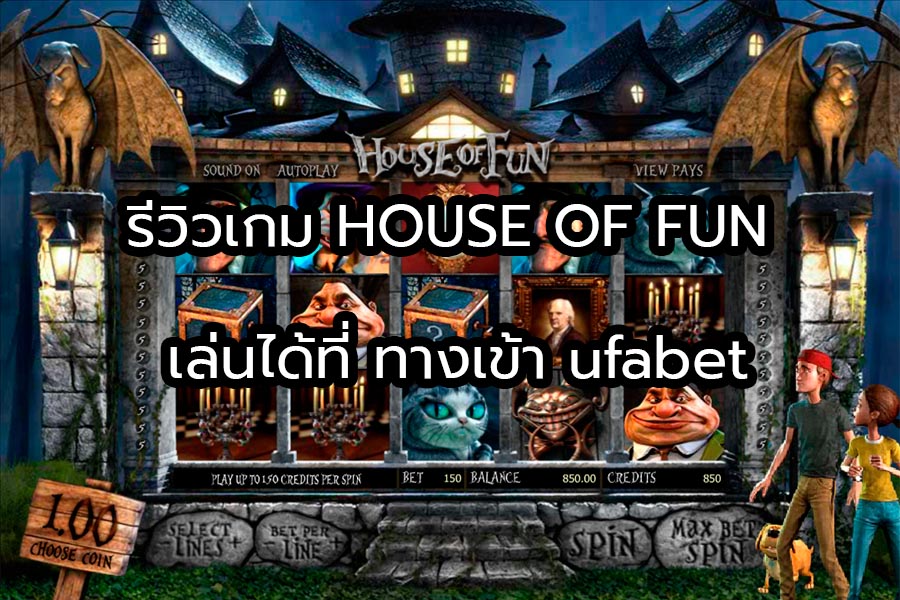

รีวิวเกม HOUSE OF FUN เล่นได้ที่ ทางเข้า ufabet

วันนี้เราจะพาไปรู้จักกับเกมสล็อตออนไลน์ ของค่ายที่ใหญ่ที่สุดในตอนนี้อย่าง pgslot ตอนนี้มีเกมใหม่เกิดขึ้นทุกวันๆและแต่ละเกมก็สนุกมากๆอีกด้วย เกมนี้มาในธีมสยองขวัญ เนื้อเรื่องจะเกี่ยวกับเด็กสองคนที่ติดอยู่ในปราสาท และมีเหล่าสัตว์ประหลาดมากมายซ่อนตัวอยู่ ถือเป็นเกมใน ทางเข้า ufabet ที่สนุกและตื่นเต้นเป็นอย่างมาก ส่วนรูปแบบของเกมจะเป็นแบบ สล็อต 5 วงล้อ มีทั้งหมด 20 ไลน์ เส้นไลน์ของโบนัสจะเรียงจากซ้ายไปขวา ยิ่งไปกว่านั้นก่อนเล่นเราควรศึกษากติกาของเกมให้ดี ดูไลน์ของรางวัลเป็นหลัก จำสัญลักษณ์ของเกมให้ได้แม่นๆ เราจะได้เข้าใจตัวเกมอย่างถ่องแท้ เกมสล็อตเล่นง่ายแต่จะต้องศึกษาพวกสัญลักษณ์เยอะเพราะแต่ละเกมก็มีไม่เหมือนกัน ทางเข้า ufabet ที่มีเกมพีจีสล็อต แต่ละเกมก็มีความแตกต่างกัน อย่างสัญลักษณ์รางวัลต่างๆของเกมนี้ ที่อันไหนได้สปินฟรี และ มีอัตราการจ่ายสูงสุดอยู่ที่เท่าไหร่ วันนี้เราจะมาดูกันว่ามีสัญลักษณ์อะไรบ้าง สัญลักษณ wild แทนทุกสัญลักษณ์ ยกเว้นสัญลักษณ์ scatter สัญลักษณ์การกระจาย bonus ปรากฏในวงล้อตั้งแต่ 3 สัญลักษณ์ขึ้นไป รับฟรีสปินสูงสุด 10 ฟรีสปิน สัญลักษณ์ เจ้าของบ้าน ปรากฏในวงล้อตั้งแต่ 3 สัญลักษณ์ขึ้นไป อัตราจ่ายสูงสุด 10 เหรียญ สัญลักษณ์ […]

พื้นฐานที่ควรมีเมื่อคิดจะแทงบอลกับ sbobet มือถือ

เชื่อว่าหลากหลายคนก็มักจะมีแนวทางในการเล่นแทงบอลหรือเลือกคู่ที่จะแทงกันอยู่แล้ว แต่สิ่งที่สำคัญเลยที่ขาดไม่ได้นั้นก็คือเรื่องเกี่ยวกับพื้นฐานหรือความเข้าใจที่ควรจะมี เพราะหลายคนกว่าจะเป็นเซียนแทงบอลกับ sbobet มือถือ ได้ ก็ต้องรู้จักเรียนรู้พื้นฐานกันมาก่อนทั้งสิ้น โดยทุกวันนี้การเดิมพันแทงบอลนั้นก็มีหลากหลายรูปแบบ โดยแต่ละรูปแบบก็จะมีความยากง่ายที่แตกต่างกันออกไป โดยบางอย่างเราสามารถที่จะเลือกเล่นได้เลยแค่ผ่านการวิเคราะห์นิดหน่อย แต่สำหรับแบบที่เจาะลึกเลยไป เทคนิคก็อาจจะเป็นส่วนสำคัญในการเล่นเพื่อให้ชนะอีกด้วย ซึ่งเทคนิคที่เราจะมาบอกกันในวันนี้ เชื่อได้เลยว่าจะสร้างประโยชน์ให้กับเหล่านักพนัน sbobet มือถือ เป็นอย่างมาก และเทคนิคเหล่านี้ก็จะช่วยสร้างโอกาสในการเพิ่มอัตราการชนะได้มากยิ่งขึ้น โดยเทคนิคดังกล่าวก็จะมีดังต่อไปนี้ 1.การเรียนรู้จากช่องทางการวิเคราะห์ต่างๆ แน่นอนว่าเมื่อเรายังไม่ได้เก่งมากนัก การสืบค้นแสวงหาการทำนายผลจากเหล่ากูรูก็เป็นเรื่องที่สำคัญ เพราะมันจะเป็นตัวช่วยในการตัดสินใจได้เป็นอย่างดี แม้ว่าเรื่องนี้เองอาจจะดูว่าเป็นเพียงการคาดเดา แต่มันก็ยังจะส่งผลที่ดีกว่าหากท่านไม่รู้หรือทราบอะไรเกี่ยวกับบอลคู่ที่ท่านจะเลือกแทงกับ สโบเบ็ต เลย 2.เทคนิคการดูราคาบอลไหลก็เป็นสิ่งสำคัญเมื่อคิดจะเล่น การดูราคาบอลไหลนั้นส่วนใหญ่แล้วนักพนันมืออาชีพจะสามารถกะเกณฑ์ได้อยู่ตลอด และก็จะเลือกเดิมพันเมื่อคิดว่าได้ราคาที่ดีที่สุด เพราะฉะนั้นแล้วหากเราเป็นนักพนันบอล sbobet มือถือ หน้าใหม่ เทคนิคนี้ก็เป็นอีกหนึ่งสิ่งที่ควรจะเรียนรู้

แทงบอล sbobet มือถือ จนได้ดี มีอยู่จริง

คุณเชื่อหรือไม่ว่าทุกวันนี้การเล่นพนันออนไลน์ก็กลายเป็นหนึ่งในอาชีพที่หลายคนสามารถสร้างรายได้ได้เป็นอย่างดี และหนึ่งในนั้นก้คือการได้แทงบอลกับ sbobet มือถือ โดยการแทงบอลนั้นเชื่อได้เลยว่าอยู่คู่กับคนไทยมาเป็นเวลาที่ค่อนข้างยาวนาน แน่นอนว่าเมื่อก่อนอาจจะมีความยากลำบากในการแทง เพราะมีตัวเลือกที่ไม่มากนัก โดยบางคนอาจจะเริ่มมาจากการเล่นผ่านโพยบอลที่สมัยก่อนเราจะเห็นได้ทั่วๆไป แต่ในทุกวันนี้รูปแบบการเล่นก็ได้เปลี่ยนไปมาก จากโพยก็กลายมาเป็นเว็บไซด์ที่มีความสะดวกและง่ายดายกว่าเมื่อก่อน อีกทั้งความเสี่ยงในการเล่นก็ถือได้ว่าแทบไม่มี อีกทั้งในเรื่องของการหาสถิติการแข่งขัน รวมไปถึงการสืบค้นความพร้อมของทีมที่จะเลือกแทง ก็สามารถหาดูได้ง่ายๆผ่านข่าวสารในอินเตอร์เน็ต ด้วยเหตุผลทั้งหมดทั้งมวลที่กล่าวมานี้ มันจึงทำให้มีหลายๆคนหันมาจับจ้องเป็นนักพนันบอลออนไลน์กับ sbobet มือถือ เป็นจำนวนมาก และบอกได้ว่าก็มีทั้งคนที่ไม่ประสบความสำเร็จและคนที่ประสบความสำเร็จ ในส่วนของคนที่จริงจังพยายามสืบค้นข้อมูลการเล่นหรือเรียกได้ว่าเป็นนักพนันมืออาชีพ ส่วนใหญ่แล้วคนเหล่านี้จะเล่น สโบ จนรวยและได้ดีอยู่หลายคน โดยบางคนเองอาจจะเริ่มต้นในการเข้ามาเป็นสมาชิกเพียงแค่เงินหลักร้อยหรือหลักพัน แต่ในปัจจุบันนั้นบอกเลยว่า คนเหล่านั้นสามารถสร้างเงินได้เยอะแยะมากมาย เผลอๆมากกว่าเงินเดือนที่หลายคนได้รับซะอีก เพราะฉะนั้นแล้วอย่าคิดแค่ว่าการเล่นแทงบอล sbobet มือถือ จะมีแต่เสียเงิน เพราะถ้าหากคุณจริงจังและตั้งใจจริงๆ มันก็จะสามารถสร้างเงินได้เหมือนกัน

เลือกเล่นความสนุกได้หลากหลายผ่านเว็บ sbobet มือถือ

ต้องบอกก่อนเลยว่าตอนนี้เว็บพนัน sbobet มือถือ นั้น กำลังเป็นที่นิยมอย่างมากสำหรับคนไทยหลายๆท่าน อาจจะเพราะด้วยเหตุผลว่าเป็นเว็บใหญ่ที่ทุกคนสามารถกดเข้ามาเล่นได้โดยไม่มีการปิดกั้น ไม่ว่าจะเป็นการเล่น แทงบอลสโบเบ็ต คาสิโนออนไลน์ สล็อตออนไลน์ เกมยิงปลา และอื่นๆอีกมากมาย ท่านสามารถเลือกเล่นได้ตามความต้องการหรือความถนัดได้เลย แต่ถ้าหากพูดถึงการให้บริการของเว็บแล้ว การพนันที่เป็นที่หนึ่งในใจเสมอมาก็คงหนีไม่พ้นการแทงบอล เพราะคนไทยหลายคนอาจจะคุ้นชินกับมันมาเป็นระยะเวลาที่ค่อนข้างยาวนาน มันจึงทำให้ตัวเองรู้สึกว่าเหมาะสมกับการเล่นพนันชนิดนี้เป็นอย่างมาก อีกทั้งความสนุกที่การได้ดูฟุตบอลไปและเดิมพันไปด้วย ก็เพิ่มความตื่นเต้นเร้าใจ โดยไม่รู้สึกเบื่อหน่ายกันเลยทีเดียว ส่วนคาสิโนออนไลน์ของ sbobet มือถือ นั้น ก็ต้องบอกด้วยอีกว่า ความนิยมชมชอบของคนไทยไม่เคยลดลงไปเลยสักนิด ถึงแม้ว่าทุกวันนี้จะมีค่ายอื่นๆที่ให้บริการมากมาย แต่หลายๆคนก็ยังให้ความไว้วางใจอยู่กับเว็บนี้อยู่ดี เรียกได้ว่าทั้งสนุกและรู้สึกปลอดภัยในเรื่องของการเงินอีกด้วย และที่จะไม่พูดถึงเลยไม่ได้นั้นก็คือเหล่าพวกเกมสล็อตออนไลน์และยิงปลา ถึงแม้ว่าพวกเกมเหล่านี้พึ่งจะมาโด่งดังในภายหลัง แต่บอกเลยว่าฐานของคนเล่นนั้นไม่ได้ด้อยน้อยกว่าการพนันอื่นๆเลย เผลอๆการเล่นเกมเหล่านี้ก็ดูเหมือนจะมีการเล่นกันตลอดเวลา 24 ชั่วโมงเลยก็ว่าได้ เพราะมันมีทั้งความสนุกและความมันส์ของแต่ละเกมแฝงอยู่ในตัว ด้วยเหตุนี้ไม่ว่าท่านจะมาเป็นสมาชิก sbobet มือถือ เพื่อเล่นพนันอะไรก็ตามแต่ การเดิมพันเหล่านั้นก็จะสร้างความสนุกและตื่นเต้นให้กับท่านได้อย่างแน่นอน

แทงบอลกับ sbobet มือถือ มีโปรโมชั่นดีดีให้เสมอ

หลายคนเมื่อเลือกที่จะเข้ามาสู้วงการพนันบอลหรือวงการการเล่นพนันออนไลน์แล้ว ก็ใช่ว่าจะเพียบพร้อมในเรื่องของการเงินไปซะทุกคน ด้วยเหตุนี้เองมันจึงมีแรงจูงใจหลายๆอย่าง ที่ทุกๆเว็บ รวมไปถึง sbobet มือถือ เอง ก็จำเป็นที่จะต้องมี และหนึ่งในนั้นก็คือเรื่องโปรโมชั่นสำหรับสมาชิกนั้นเอง อย่างที่หลายคนเชื่อกันว่าเว็บพนันที่ดีต้อวมีโปรโมชั่น เรื่องนั้นก็คงไม่ใช่เป็นเรื่องที่ผิด ยกตัวอย่างเช่นเว็บ สโบ ที่ให้บริการในไทยจากหลายๆเว็บ ก็มักจะมีโปโมชั่นต่างๆเข้ามาเพื่อเป็นแรงชักจูงให้คนเลือกเล่นกับเว็บเขาอยู่เสมอ โดยทุกวันนี้บอกเลยว่าโปรต่างๆก็มีเยอะแยะมากมายเลยทีเดียว ไม่ว่าจะเป็นโบนัสสำหรับสมาชิกใหม่ โปรฝากแรกของวัน โปรชวนเพื่อนมาเล่น และอื่นๆอีกมากมาย ซึ่งพวกโปรเหล่านี้เองเว็บ sbobet มือถือ ก็มีให้ท่านได้รับเลือกโบนัสด้วยเช่นเดียวกัน บอกเลยว่าคุ้มซะยิ่งกว่าคุ้ม แต่ยิ่งไปกว่านั้น ต่อให้โปรโมชั่นดีเพียงใด แต่ถ้าหากตัวผู้เล่นไม่ศึกษาเว็บที่ให้บริการดีดีก่อน ก็อาจจะต้องตกเป็นเหยื่อของมิจฉาชีพได้ เพราะบางทีเว็บที่โกงก็จะเอาโปรโบนัสฟรีมาให้แบบเกินจริง เพื่อต้องการหลอกให้คนคลิกเข้าไปสมัครและฝากยอดแรก จากนั้นก็จะทำการหนีหายไปทันที ด้วยเหตุนี้แหละที่ว่าทำไมเว็บ sbobet มือถือ จึงได้มีโปรโมชั่นต่างๆเข้ามา เพราะการเล่นกับเว็บนี้ ท่านจะสามารถไว้วางใจได้กว่าเจ้าอื่นๆ เพราะด้วยระยะเวลาที่เปิดให้บริการ บวกกับความน่าเชื่อถือที่มีมายาวนาน มันจึงทำให้เป็นเว็บไซด์ที่น่าใช้บริการอย่างมากที่สุดเลยก็ว่าได้

เล่นพนันบอล sbobet มือถือ ควรเล่นอย่างมีเป้าหมาย

การเล่นพนันบอลที่ดีเริ่มต้นจากอะไร เคยมีใครตั้งคำถามกันบ้างไหมครับ จริงๆแล้วมันก้ไม่ใช่เพียงแค่พนันบอลหรอก ไม่ว่าจะเป็นการพนันชนิดใด สิ่งแรกที่เราควรคำนึงถึงตลอดเวลานั้นก็คือเป้าหมายในการเล่น ซึ่งคนที่เล่นกับเว็บ sbobet มือถือ เชื่อว่าแต่ละคนนั้นก็มีเป้าหมายที่แตกต่างกันออกไป บางคนเข้ามาเล่นเพื่อแทงบอลและหวังเงินจากเพียงบอลคู่เดียว บางคนเองก็มีเป้าหมายว่าวันนี้จะวิเคราะห์อย่างหนักเพื่อให้บอลสเต็ปแตก ซึ่งความคิดเหล่านั้นก็ไม่ใช่เรื่องที่ผิด แต่ถ้าจะให้เราแนะนำแล้วนั้นก็จะบอกเลยว่า เป้าหมายก็คงหมายถึงจำนวนของยอดเงินที่เราต้องการในแต่ละวันมากกว่า บางคนมีเงินทุนต่ำ บางคนมีเงินทุนมาก เป้าหมายแน่นอนว่ามันจะต้องแตกต่างกันออกไป แต่สิ่งที่สำคัญที่สุดคือเม็ดเงินที่ควรจะต้องได้รับในวันหรือสัปดาห์หรือเดือนนั้นๆ การแทงบอล sbobet มือถือ เป็นสิ่งที่ทุกคนทำได้ สำหรับคนทุนน้อยแล้วเราต้องขอแนะนำว่าให้ได้กำไรเพียงแค่วันละหลักร้อยหรือหลักพันก็เพียงพอ เท่านั้นก็คงจะพอกับค่าใช้จ่ายในแต่ละวัน เผลอๆได้มากกว่าค่าแรงขั้นต่ำเสียอีก แต่สำหรับคนที่เล่น สโบเบ็ต ด้วยงบเยอะ ผู้คนเหล่านี้สิ่งที่ควรจะต้องระวังให้มากที่สุดคือเรื่องของการหัวร้อน เพราะถ้าหากบอลแพ้แล้วทุ่มทั้งหน้าตัก อาจจะถึงขั้นเสียบ้านเสียรถกันเลยก็ว่าได้ เพราะฉะนั้นแล้วเป้าหมายในการเล่นแต่ละวันจึงจำเป็นที่จะต้องชัดเจนมากๆ เสียเท่าไรจึงพอ ได้เท่าไรจึงหยุด แค่หลักเกณฑ์แค่นี้ คุณก็สามารถที่จะทำเงินมหาศาลกับ sbobet มือถือ มากเพียงพอแล้ว เพราะฉะนั้นเล่นให้สนุก มีเป้าหมายในการเล่น รับรองว่าจะส่งผลดีไม่มากก็น้อยอย่างแน่นอน